You're paying for 40 hours—but only getting 32.

Financial stress is costing you 8 hours per employee, every week.[1]

Offer your team a free “Money Masterclass”– at zero cost to your business.

The Money Masterclass

*We’ll use this quick call to tailor the session to your workplace priorities — whether that’s engagement, retention, or simply offering more support to your team.

| Verified Review

Herman

I have no words to describe how great this class was!

Well thought out, easy to understand and can implement immediately. Highly recommended!

| Verified Review

Megan

We are so grateful

Sean, you helped us 6 years ago get our situation in order, become debt-free, acquire investment accounts and purchase a home!

| Verified Review

Ryland

This class was really interesting.

I never knew about the rule of 72. I couldn’t take notes fast enough.

| Verified Review

Herman

I have no words to describe how great this class was!

Well thought out, easy to understand and can implement immediately. Highly recommended!

| Verified Review

Megan

We are so grateful

Sean, you helped us 6 years ago get our situation in order, become debt-free, acquire investment accounts and purchase a home!

| Verified Review

Ryland

This class was really interesting.

I never knew about the rule of 72. I couldn’t take notes fast enough.

The payroll problem no one talks about.

Every week, employees spend as much as 8 hours on personal money problems—while on your time[1].

That’s nearly 20% of your payroll lost to invisible distractions and financial burnout.

Give your team a plan, not just a paycheck.

Your employees don’t need a raise to feel financially secure—they need a better plan for the money they already earn.

Give your team the tools to take control of their finances so they can bring their best energy and focus back to work.

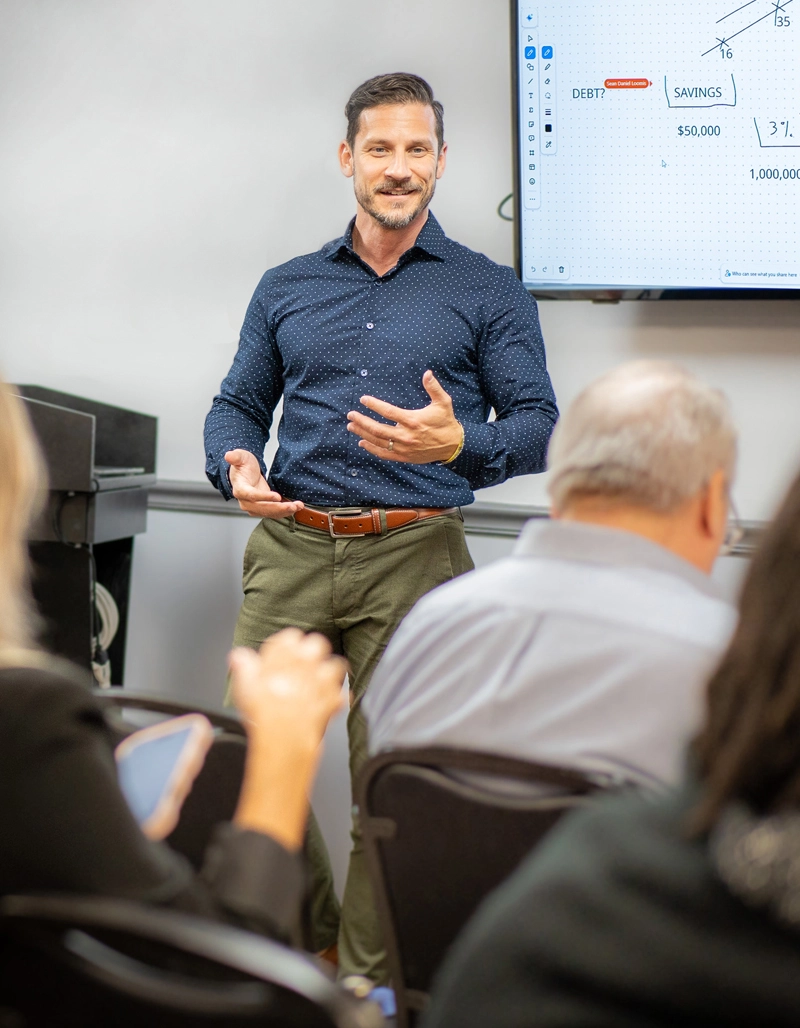

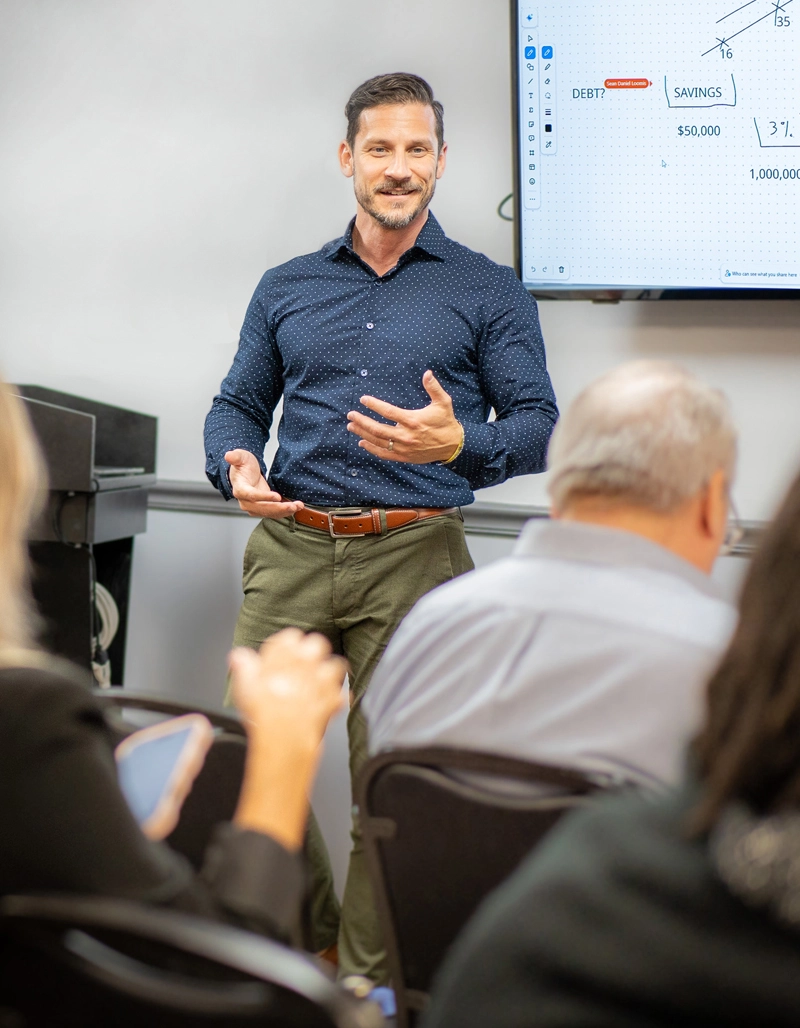

Sean & April Loomis

Financial Educators & Money Mastery Coaches

Licensed: Series 6, Series 63, Series 65, & Life Insurance

Give your team a plan, not just a paycheck.

Your employees don’t need a raise to feel financially secure—they need a better plan for the money they already earn.

Give your team the tools to take control of their finances so they can bring their best energy and focus back to work.

Sean & April Loomis

Financial Educators & Money Mastery Coaches

Licensed: Series 6, Series 63, Series 65, & Life Insurance

Give your team a plan, not just a paycheck.

Your employees don’t need a raise to feel financially secure—they need a better plan for the money they already earn.

Give your team the tools to take control of their finances so they can bring their best energy and focus back to work.

Sean & April Loomis

Financial Educators & Money Mastery Coaches

Licensed: Series 6, Series 63, Series 65, & Life Insurance

The Money Masterclass:

Fix your most expensive employee problem.

A 45-minute financial wellness session + 15-minute Q&A—hosted onsite with breakfast or lunch provided.

This high impact session will give your team clear, actionable steps to make smarter financial decisions, starting immediately.

| Verified Review

Ruthe

The seminar was amazing!

Everything was explained in a simple, clear way, and I left feeling motivated and excited. The positive energy made it both inspiring and enjoyable. Highly recommend!

The Money Masterclass:

Fix your most expensive employee problem.

A 45-minute financial wellness session + 15-minute Q&A—hosted onsite with breakfast or lunch provided.

This high impact session will give your team clear, actionable steps to make smarter financial decisions, starting immediately.

| Verified Review

Ruthe

The seminar was amazing!

Everything was explained in a simple, clear way, and I left feeling motivated and excited. The positive energy made it both inspiring and enjoyable. Highly recommend!

The Money Masterclass:

Fix your most expensive employee problem.

A 45-minute financial wellness session + 15-minute Q&A—hosted onsite with breakfast or lunch provided.

This high impact session will give your team clear, actionable steps to make smarter financial decisions, starting immediately.

| Verified Review

Ruthe

The seminar was amazing!

Everything was explained in a simple, clear way, and I left feeling motivated and excited. The positive energy made it both inspiring and enjoyable. Highly recommend!

*This quick planning call ensures the session fits your culture, schedule, and what your employees care about most.

"We help employers invest in what matters most—their people.

The result—healthier employees, stronger culture, and measurable gains in performance and retention."

The Cashflow Couple

*This quick planning call ensures the session fits your culture, schedule, and what your employees care about most.

The Cashflow Couple

The result—healthier employees, stronger culture, and measurable gains in performance and retention."

"We help employers invest in what matters most—their people.

Inside This Session:

How To Turn Your Paycheck Into a 7-Figure Future

(From 40 hour grind—to money that

never clocks out).

- The money truth they should have taught you in school

Uncover the simple, but powerful money formula the rich use to double their money — and the powerful mindset shift that collapses decades into years.

- Your “never work again” number

Discover the single most important number of your life — and the fastest, most achievable path to reach it.

How to end the money fights—for good.

Money stress silently poisons relationships. Unpack the tools to flip tension into teamwork — so you and your partner move in lockstep toward your financial dreams.

The sneaky credit card trick that makes you pay 12x what you owe

Banks don’t want you to know this — but one simple line on your statement could lock you into years of payments and cost you twelve times what you actually owe. Here’s how to spot it… and beat them at their own game.

The silent wealth killer hiding in your tax return

It’s the best-kept secret in the tax game: a hidden line item most people overlook, but the rich use to turn dollars into more dollars. Spot it in your return, and you could turn a hidden drain into a lifetime of gains.

How financial predators trick even smart people — and how to dodge their traps like a pro

They’re hunting your wallet — and they’re good at it. Even the smartest people get caught in their traps. Learn their tactics, outsmart their tricks, and make yourself untouchable.

BONUS: How to set your kids up to be millionaires — even if you can only spare a few dollars a month

Inside This Session:

How To Turn Your Paycheck Into a 7-Figure Future

(From 40 hour grind—to money that

never clocks out).

Uncover the simple, but powerful money formula the rich use to double their money — and the powerful mindset shift that collapses decades into years.

- The money truth they should have taught you in school

Discover the single most important number of your life — and the fastest, most achievable path to reach it.

- Your “never work again” number

Money stress silently poisons relationships. Unpack the tools to flip tension into teamwork — so you and your partner move in lockstep toward your financial dreams.

- How to end the money fights—for good.

Banks don’t want you to know this — but one simple line on your statement could lock you into years of payments and cost you twelve times what you actually owe. Here’s how to spot it… and beat them at their own game.

- The sneaky credit card trick that makes you pay 12x what you owe

It’s the best-kept secret in the tax game: a hidden line item most people overlook, but the rich use to stack profits. Spot it in your return, and you could turn a hidden drain into a lifetime of gains.

- The silent wealth killer hiding in your tax return

They’re hunting your wallet — and they’re good at it. Even the smartest people get caught in their traps. Learn their tactics, outsmart their tricks, and make yourself untouchable.

- How financial predators trick even smart people — and how to dodge their traps like a pro

- BONUS: How to make your kids millionaires (with just a few bucks a month)

The employer's cheat code to high- performance teams:

Stop bleeding profits

The average financially stressed employee wastes $1,900/year of your payroll just worrying about money at work[2]. A financial wellness program plugs that leak and saves you thousands.

Recover lost productivity

Employees spend up to 8 work hours every week on personal money problems[3]—that’s a full workday, gone. Give them financial tools, and you reclaim those hours.

Slash turnover in half

Stressed employees are 2× more likely to job-hunt[4]. Financial coaching makes them stay, cutting the massive cost of recruiting and retraining replacements.

Kill absenteeism before it kills you

When employees feel financially supported, unplanned absences drop by 24%[5]. The result: healthier employees and a more reliable workforce.

Win the talent war

76% of jobseekers say they prefer employers that care about financial well-being[6]. Offer it, and you attract the best talent.

*We’ll use this quick call to tailor the session to your workplace priorities — whether that’s engagement, retention, or simply offering more support to your team.

When your employees thrive at home, they show up stronger at work

When families are stressed about money, it doesn’t stay at home — it shows up at work as distraction, burnout, absenteeism, and even turnover.

We partner with employers to deliver simple, step-by-step financial coaching that helps working families thrive in both their personal and professional lives.

When your employees thrive at home, they show up stronger at work

When families are stressed about money, it doesn’t stay at home — it shows up at work as distraction, burnout, absenteeism, and even turnover.

We partner with employers to deliver simple, step-by-step financial coaching that helps working families thrive in both their personal and professional lives.

Bring the Money Masterclass to Your Workplace

Fill out the form to book a quick 15-minute planning call. We’ll customize a free workplace session to fit your team’s needs.

Step 1

*We respect your inbox. No spam. Ever.

- SoFi At Work, 2024 (summary citing 8.2 on-the-job hours).

Source

↩︎ - John Hancock Financial Stress Survey (press release), 2019 – $1,900 per employee per year.

Source

↩︎ - SoFi At Work, 2024 (8.2 hours on the job).

Source

↩︎ - PwC Employee Financial Wellness Survey, 2023 – financially stressed employees are 2× more likely to look for a new job (36% vs 18%).

Source

↩︎ - Society of Actuaries (Financial Wellness Essay Collection, 2017) – unplanned absences fell from 13.73 to 10.35 hours (~24%) as financial wellness improved.

Source

↩︎ - Job attraction to employers that care about financial well-being:

PwC 2023 (73% of financially stressed employees)

Source A

and a 2022 summary citing 76%

Source B.

↩︎